The Way We Do Business Is About to Change

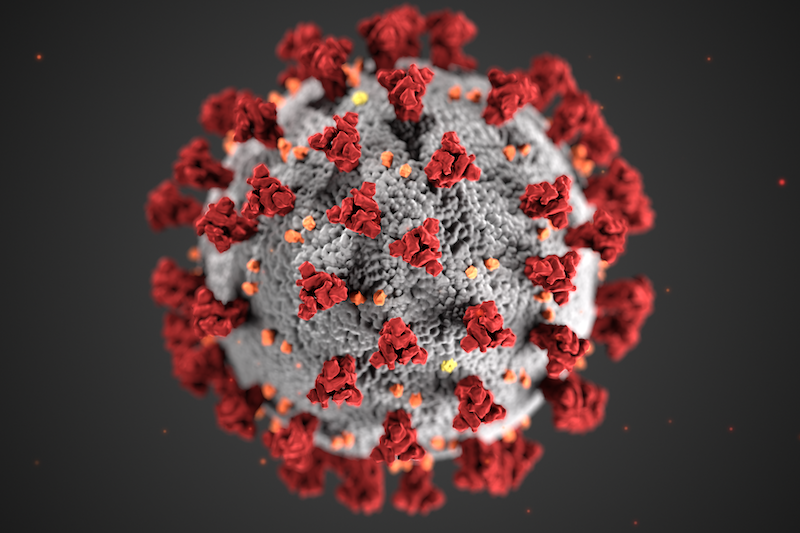

There seems to be an agreement in the insurance industry that, due to the coronavirus pandemic, the way we do business is likely to change—not just in the short-term, but also on a long-term basis. That doesn’t mean that we expect the coronavirus to be with us long term; we’re all hoping that isn’t the case. But it does mean that, during the COVID-19 lockdown, agents have developed some new habits that are likely to stay with us long after the health emergency is over and everyone is allowed to return to the office.

Read The Way We Do Business Is About to Change