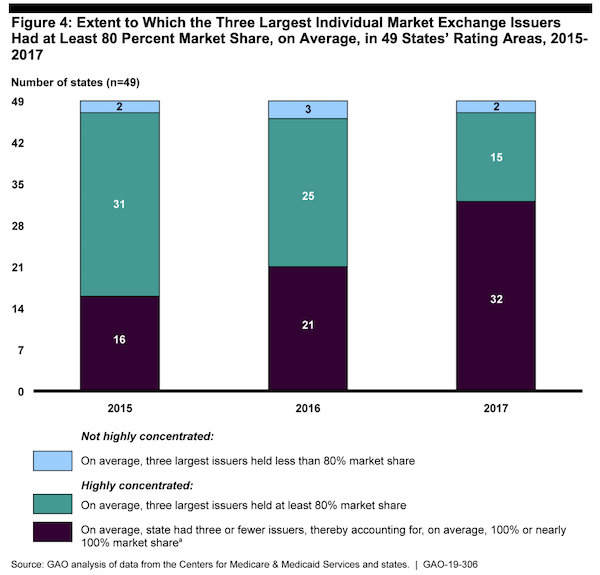

Health Insurance Market Dominated by a Handful of Carriers

Those who oppose the single-payer health insurance plan promoted by Bernie Sanders in his 2016 presidential campaign, and supported by most Democratic candidates in the 2020 race, often argue that competition is good for the market; it helps improve quality and reduce costs because consumers shop with their wallets. Many insurance agents would agree with this assessment: competition, in most cases, is good for consumers. However, what is often left unsaid in the conversation about competition in the health insurance industry is that it doesn’t really exist, at least not to the extent that we would like to believe it does.

Read Health Insurance Market Dominated by a Handful of Carriers