Medicare Premiums Vary By Income

If you sell Medicare supplements, Medicare Advantage plans, or Medicare Part D prescription drug plans, you’ve probably been asked on multiple occasions how much Medicare Part B costs. If you’re like a lot of agents, you may have answered with the standard Part B premium amount, which is $134 per month in 2018. This can be dangerous.

It turns out that the amount people pay for both Medicare Part B and Medicare Part D can vary wildly by income, so before giving a generic answer with the cost that applies to most Medicare recipients, you should ask a couple questions. Better yet, you can simply provide your clients with the information about how Part B and Part D premiums are determined and then let them answer the question themselves.

Not everyone pays the same premium for Part B

While the majority of people pay the standard Medicare Part B premium, some pay less and some pay more depending on their situation.

- People who had Medicare prior to 2018 and who pay their Part B premiums through deductions from their Social Security checks may pay less than the standard premium.

- Medicaid may pay the Medicare Part B premium for people who are eligible for both Medicare and Medicaid (also known as dual eligibles).

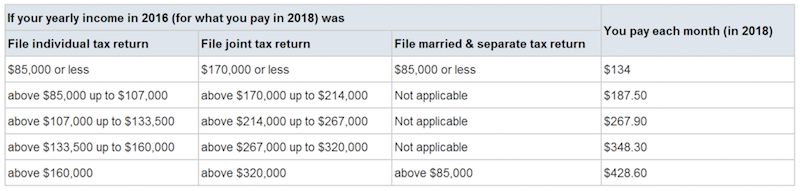

- Medicare beneficiaries whose income two years ago was above a certain amount actually pay more for Medicare. This is called an “Income Related Monthly Adjustment Amount” (IRMAA). The amount of the adjustment also varies by income. See the chart below from the Medicare.gov website.

Part D varies by income as well

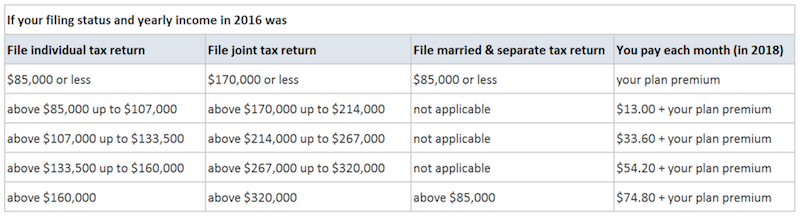

For high income earners, there’s also an Income Related Monthly Adjustment for Medicare Part D. Note that the “total cost” shown on Medicare.gov when someone searches for a Part D plan does not include the IRMAA. The chart below from the Medicare.gov website shows the premium adjustments for Medicare Part D.

Don’t forget about the penalties!

Another thing to be aware of is the fact that some people pay more for Medicare Parts B and D if they fail to sign up when they are first eligible.

For Medicare Part B, there is a 10% penalty per year for beneficiaries without job-based coverage from active employment (as an employee or spouse) who do not sign up when they turn 65 (or when they lose their job-based coverage), and that penalty continues for the rest of their lives. Most people do not make this mistake, but some do.

For Medicare Part D, there is a 1% penalty per month for every month an individual without other creditable coverage is eligible but not enrolled. This is also a lifetime penalty, and it’s more common than the Medicare Part B penalty. People working past age 65 often stay on their group health plan, and increasingly those plans have a high deductible that also applies to their prescription benefit. Depending on the deductible amount, the group plan may not be “creditable” coverage, which means that the employee may get hit with a penalty when he or she signs up for Part D.

Be Careful!

Long story short, you shouldn’t make assumptions about the amount your clients and prospects will pay for Part B or Part D as it can vary significantly for a number of reasons. The last thing you want to do is help someone with the math and find out later that you used the wrong numbers. The decision about whether to stay on the group health plan or sign up for Medicare is an important one, so make sure you’re using the correct figures when advising your clients.