Appealing an Income-Related Medicare Adjustment

If you sell Medicare supplements or Medicare Advantage plans, you probably know that the standard Medicare Part B premium for 2022 is $170.10.

You may also know that about five percent of Medicare beneficiaries pay more than the standard Part B premium. This is known as an Income-Related Medicare Adjustment Amount, or IRMAA.

As ThinkAdvisor points out, “IRMAAs can be applied to premiums for Parts B and D, and are calculated based on your client’s tax information from two years ago. So, for 2022, tax filings from 2020 would be used to make a determination.”

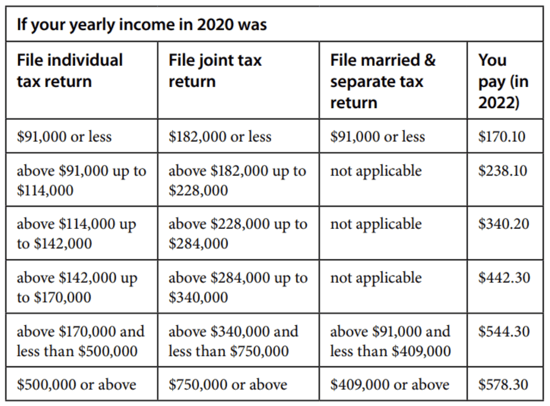

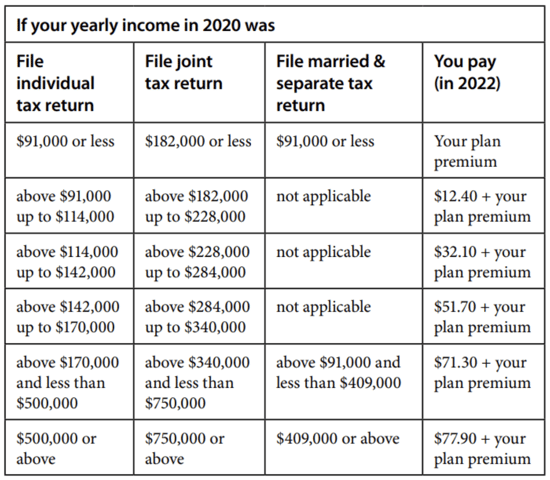

The Medicare.gov website includes charts that show the amounts that people at various income levels would pay for Medicare Part B and Part D.

Medicare Part B

Medicare Part D

Did you know, though, that your clients can actually appeal their Income-Related Medicare Adjustment Amount? The appeals are handled by the Office of Medicare Hearings and Appeals (OHMA), which is part of the U.S. Department of Health and Human Services (HHS).

Did you know, though, that your clients can actually appeal their Income-Related Medicare Adjustment Amount? The appeals are handled by the Office of Medicare Hearings and Appeals (OHMA), which is part of the U.S. Department of Health and Human Services (HHS).

As Medicare.gov explains, “you must request a reconsideration of the initial determination from the Social Security Administration. A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772.1213) as well as by writing to SSA.”

A reconsideration can be requested if the beneficiary’s tax return is inaccurate or out of date. Additionally, there are seven life-changing events “which may qualify a beneficiary for a new Part B determination”:

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income producing property

- Loss or reduction of certain kinds of pension income

If any of your clients believe they may qualify for an IRMAA reconsideration, you may want to direct them to this page of the Medicare.gov website for more information: https://www.hhs.gov/about/agencies/omha/the-appeals-process/part-b-premium-appeals/index.html