HSA and ACA Limits for 2026

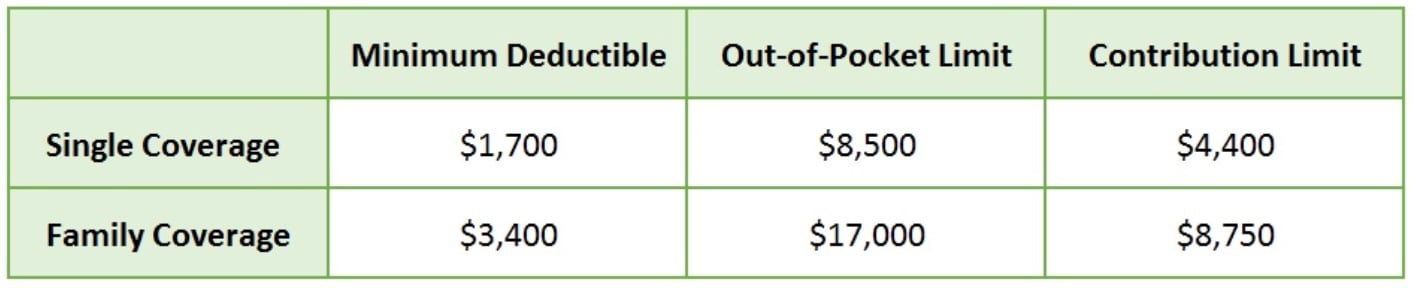

The Internal Revenue Service has announced the 2026 deductible, out-of-pocket, and contribution limits for Health Savings Accounts (HSAs). Here they are:

Compared with 2025, the minimum deductible for people with single coverage is increasing by $50, from $1,650 to $1,700, and the minimum deductible for people with family coverage is increasing by $100, from $3,300 to $3,400. There’s an even bigger jump in the annual out-of-pocket limit: from $8,300 to $8,500 for people with single coverage and from $16,600 to $17,000 for people with family coverage.

Compared with 2025, the minimum deductible for people with single coverage is increasing by $50, from $1,650 to $1,700, and the minimum deductible for people with family coverage is increasing by $100, from $3,300 to $3,400. There’s an even bigger jump in the annual out-of-pocket limit: from $8,300 to $8,500 for people with single coverage and from $16,600 to $17,000 for people with family coverage.

The good news is that the HSA contribution limits are also increasing for 2026. For those with single coverage, the new contribution amount will be $4,400, an increase of $100 compared with 2025. For those with family coverage, the contribution limit is increasing by $200 to $8,750. The catch-up contribution for account holders age 55 and older remains $1,000 per year and must be deposited into an account in the individual’s name. That means that married couples age 55 and older must set up separate accounts if they both want to take advantage of the catch-up contribution. There was a proposal to change this rule in the One Big Beautiful Bill, but it did not make it into the final version.

Lower Out-of-Pocket than Many Copay Plans

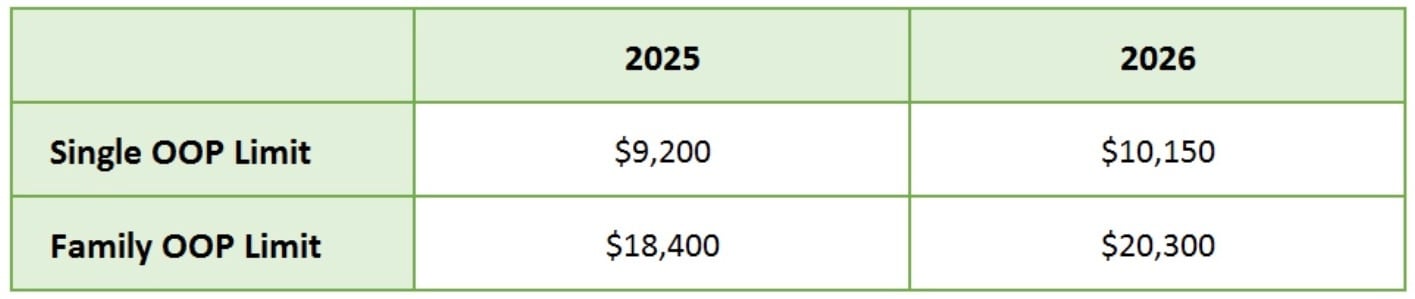

CMS has also announced the out-of-pocket limits for non-HSA-qualified ACA-metallic plans, and the in-network exposure is increasing significantly (and remains significantly higher than for HSA plans):

As we’ve mentioned in the past, HSA-qualified “High Deductible” Health Plans now provide more comprehensive coverage than traditional plans with up-front copayments, so your clients should not be scared off by the somewhat misleading term.

As we’ve mentioned in the past, HSA-qualified “High Deductible” Health Plans now provide more comprehensive coverage than traditional plans with up-front copayments, so your clients should not be scared off by the somewhat misleading term.

Supplemental Coverage Considerations

And, as we’ve also mentioned multiple times, the in-network exposure under most ACA health plans is higher than many clients are comfortable with. That’s why they may want to consider supplementing their major medical health insurance policy with other products, like accident, hospital indemnity, and critical illness policies, that can help to offset much of the deductible and out-of-pocket exposure.

Be sure to visit the AHCP Carriers page to learn about the supplemental products we offer that could help reduce your clients’ costs in the event of an accident or serious illness.