HSA Limits for 2022

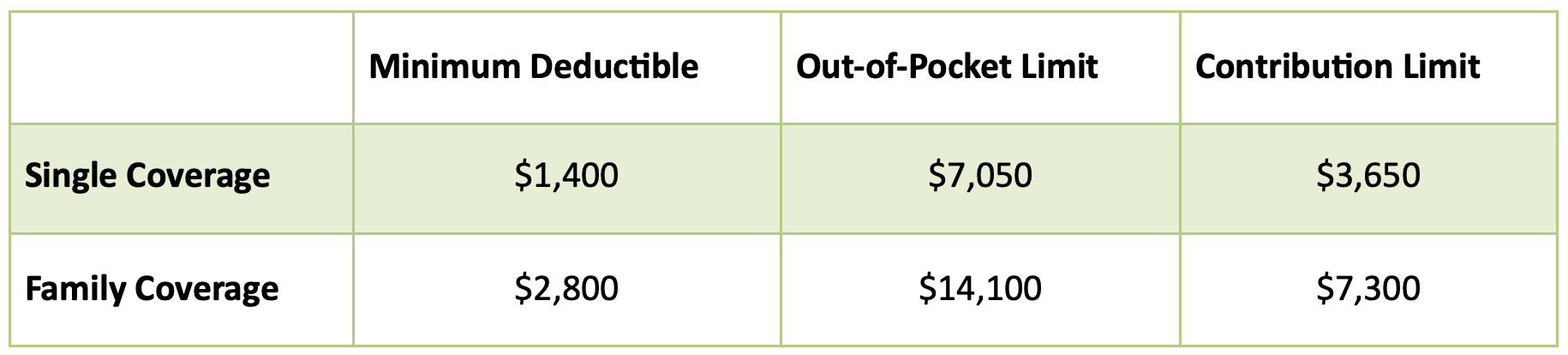

The Internal Revenue Service has announced the 2022 deductible, out-of-pocket, and contribution limits for Health Savings Accounts (HSA). Here they are:

Compared with 2021, the minimum deductible for people with single or family coverage remained the same. The out-of-pocket limit increased from $7,000 to $7,050 for people with single coverage and from $14,000 to $14,100 for people with family coverage. That is still far less than the out-of-pocket limit for non-HSA plans in 2022.

As usual, the HSA contribution limits are increasing for 2022. For those with single coverage, the new contribution amount is $3,650, an increase of $50 compared with 2021. For those with family coverage, the contribution limit is increasing by $100 to $7,300. The catch-up contribution for account holders age 55 and older remains $1,000 per year and must be deposited into an account in the individual’s name. That means that married couples age 55 and older must set up separate accounts if they both want to take advantage of the catch-up contribution.

More Comprehensive than Many Copay Plans

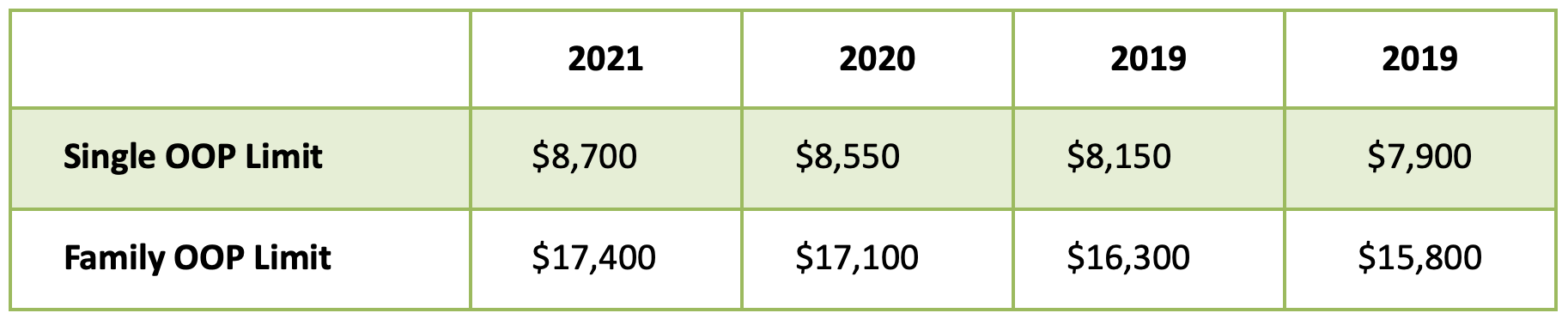

As we explained in a May 28 blog post, the Department of Health and Human Services also recently announced the out-of-pocket limits for non-HSA-qualified ACA-metallic plans, and the in-network exposure is significantly higher than for HSA plans. It is also rising much more rapidly:

As we’ve mentioned multiple times in the past, “High Deductible Health Plans” may provide more comprehensive coverage than traditional plans, so your clients should not be scared off by the somewhat misleading term.

As we’ve mentioned multiple times in the past, “High Deductible Health Plans” may provide more comprehensive coverage than traditional plans, so your clients should not be scared off by the somewhat misleading term.

“Consumer-Directed” Health Care Now Easier Than Ever

High Deductible Health Plans and Health Savings Accounts are part of the movement toward more consumerism in health care, and thanks to the No Surprises Act and other laws passed at a state level aimed at increasing price transparency while protecting consumers from unexpected medical bills, ditching the up-front copayments and giving consumers more responsibility for their health care decisions has never been easier. If you have clients who are still clinging to their copay plans, this might be the year to talk to them about an HSA-qualified plan.

In addition to the tax savings that comes with contributing to a Health Savings Account, these plans regularly provide better catastrophic protection than traditional plans with flat-dollar copayments for doctor visits and prescriptions. And, while the member will pay more for some of these lower-cost healthcare expenses, the premium savings is often more than enough to cover the additional point-of-service costs.

For more information on Health Savings Accounts or the products you should sell alongside an HSA-qualified plan, contact AHCP today.