HSA Limits for 2021

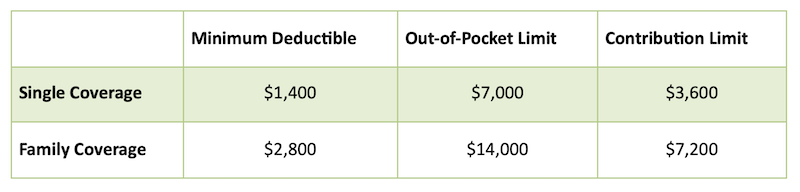

The Internal Revenue Service has announced the 2021 deductible, out-of-pocket, and contribution limits for Health Savings Accounts (HSA). Here they are:

Compared with 2020, the minimum deductible for people with single or family coverage remained the same. The out-of-pocket limit increased from $6,900 to $7,000 for people with single coverage and from $13,800 to $14,000 for people with family coverage. That is still far less than the out-of-pocket limit for non-HSA plans in 2021.

As usual, the HSA contribution limits are increasing for 2021. For those with single coverage, the new contribution amount is $3,600, an increase of $50 compared with 2020. For those with family coverage, the contribution limit is increasing by $100 to $7,200. The catch-up contribution for account holders age 55 and older remains $1,000 per year and must be deposited into an account in the individual’s name. That means that married couples age 55 and older must set up separate accounts if they both want to take advantage of the catch-up contribution.

More Comprehensive than Many Copay Plans

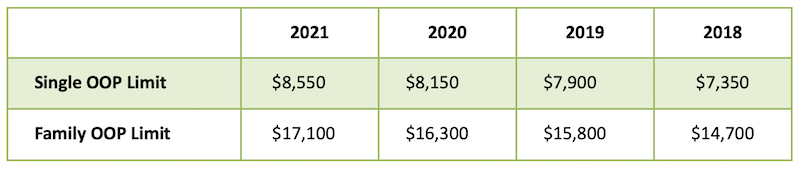

As HealthAffairs notes, the Department of Health and Human Services also recently announced the out-of-pocket limits for non-HSA-qualified ACA-metallic plans, and the in-network exposure is significantly higher than for HSA plans. It is also rising much more rapidly:

As we’ve mentioned in previous updates, “High Deductible Health Plans” now provide more comprehensive coverage than traditional plans, so your clients should not be scared off by the somewhat misleading term.

Other Changes to Health Savings Accounts

There are some other updates to Health Savings Accounts that you should be aware of:

- Coverage Prior to the Deductible: Due to the COVID-19 health emergency, the IRS is temporarily allowing High Deductible Health Plans to cover coronavirus testing and treatment prior to the minimum plan deductible without jeopardizing the plan’s HSA eligibility. Additionally, Section 3701 of the CARES Act provides an exemption for telehealth services by creating a “Safe Harbor for Absence of Deductible for Telehealth.” In short, a plan that offers up-front coverage, prior to the deductible, for telehealth and other remote care services will not disqualify a plan from HSA eligibility, and this is true for plan years beginning on or before December 31, 2021.

- 2019 Contributions: The IRS has extended the HSA contribution deadline for 2019 to July 15, 2020, to coincide with the new deadline to file 2019 tax returns.

- Section 3702 of the CARES Act makes OTC drugs an eligible HSA, FSA, or HRA expense once again. It also adds makes menstrual care products to the list of eligible expenses under these tax-advantaged accounts.

All of these changes are detailed in our May 8 article “Three Recent Changes to HSAs.”

For more information on Health Savings Accounts or the products you should sell alongside an HSA-qualified plan, contact AHCP today.