HSA Limits for 2023

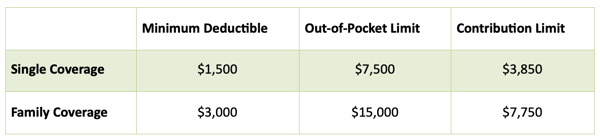

The Internal Revenue Service has announced the 2023 deductible, out-of-pocket, and contribution limits for Health Savings Accounts (HSA). Here they are:

Compared with 2022, the minimum deductible for people with single coverage is increasing by $100, from $1,400 to $1,500, and the minimum deductible for people with family coverage is increasing by $200, from $2,800 to $3,000. The annual out-of-pocket limit is increasing significantly, from $7,050 to $7,500 for people with single coverage and from $14,100 to $15,000 for people with family coverage.

Compared with 2022, the minimum deductible for people with single coverage is increasing by $100, from $1,400 to $1,500, and the minimum deductible for people with family coverage is increasing by $200, from $2,800 to $3,000. The annual out-of-pocket limit is increasing significantly, from $7,050 to $7,500 for people with single coverage and from $14,100 to $15,000 for people with family coverage.

The good news is that the HSA contribution limits are also increasing for 2023. For those with single coverage, the new contribution amount will be $3,850, an increase of $200 compared with 2022. For those with family coverage, the contribution limit is increasing by $450 to $7,750. The catch-up contribution for account holders age 55 and older remains $1,000 per year and must be deposited into an account in the individual’s name. That means that married couples age 55 and older must set up separate accounts if they both want to take advantage of the catch-up contribution.

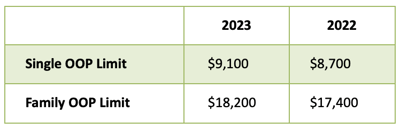

Lower Out-of-Pocket than Many Copay Plans

CMS has also announced the out-of-pocket limits for non-HSA-qualified ACA-metallic plans, and the in-network exposure remains significantly higher than for HSA plans:

As we’ve mentioned multiple times in the past, “High Deductible Health Plans” now provide more comprehensive coverage than traditional plans, so your clients should not be scared off by the somewhat misleading term.

As we’ve mentioned multiple times in the past, “High Deductible Health Plans” now provide more comprehensive coverage than traditional plans, so your clients should not be scared off by the somewhat misleading term.

The fact is that the in-network exposure under most health plans nowadays is higher than most of our clients are comfortable with. That’s why they may want to consider supplementing the health insurance policy with other products, like accident and critical illness policies, that can help to offset some of the deductible and out-of-pocket exposure. Be sure to visit the AHCP Carriers page to learn about the supplemental products we offer that could help reduce your clients’ costs in the event of an accident or serious illness.