Senate Passes Bill to Extend Subsidies, Lower Drug Costs

After a lengthy debate, and without a single Republican vote, Democrats in the Senate passed the Inflation Reduction Act, a $430 billion bill that will, among other things, extend the enhanced premium tax credits and lower drug costs.

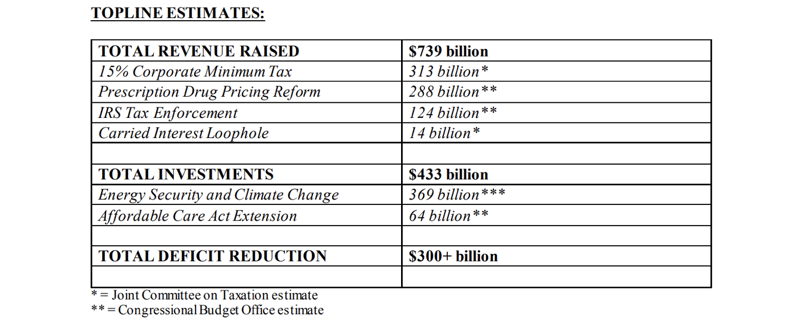

As CNN reports, the bill, if it becomes law, “would raise over $700 billion in government revenue over 10 years” while spending $430 billion to reduce carbon emissions and reduce the deficit, so it is much more than a healthcare bill, but the healthcare components of the legislation are huge.

Democrats were able to pass the legislation using the budget reconciliation process, which only requires 51 votes rather than a filibuster-proof 60 votes, when Senator Joe Manchin [D-WV] and Senate Majority Leader Chuck Schumer [D-NY] reached a deal last month. Vox explains that the 755-page bill is basically “a pared-down version of the Build Back Better Act, the Democrats’ ambitious agenda to fund health care, education, and clean energy that Manchin effectively killed back in December.” Vice President Kamala Harris cast the tie-breaking vote Sunday.

Notably, Republicans were able to kill a provision in the legislation that, according to CNBC, would have placed “a $35 cap on insulin in the private market.”

Still, Senate Democrats are cheering the passage of what Senator Schumer calls “one of the most significant pieces of legislation passed in a decade.” They published a one-page summary highlighting the key elements of the legislation, saying that the bill will “finally allow Medicare to negotiate for prescription drug prices and extend the expanded Affordable Care Act program for three years, through 2025.” Here’s a chart from the summary that shows the revenue raised and money spent by the bill.

Note that the prescription drug pricing reform is estimated to save the government $288 billion over 10 years, so it is categorized as revenue rather than expense. Along with allowing Medicare to negotiate drug prices for the first time, the bill also caps prescription out-of-pocket costs at $2,000.

Note that the prescription drug pricing reform is estimated to save the government $288 billion over 10 years, so it is categorized as revenue rather than expense. Along with allowing Medicare to negotiate drug prices for the first time, the bill also caps prescription out-of-pocket costs at $2,000.

The legislation is not finalized yet. Because changes were made from the version that passed the House last month, it will now go back to the House of Representatives for final approval.

For brokers, there are four big talking points to share with clients:

- The enhanced premium tax credits, which eliminated the subsidy cliff and increased the tax credit amount for people at all income levels, will continue another three years. That means that clients receiving financial assistance won’t see a big price increase this fall.

- Medicare will be able to negotiate drug prices, which should help save some seniors money.

- Medicare Rx out-of-pocket costs will be capped at $2,000.

- Lawmakers failed to reach an agreement on capping insulin costs for people with private health insurance.

We’ll keep an eye on the legislation and will let you know when it is finalized and signed into law by President Biden.