4 Million Individuals Could Get MLR Rebates This Year

The Kaiser Family Foundation has published two articles recently about the MLR rebates that will be sent out this fall.

The first article, from June 1, explains that “insurance companies are expecting to pay out $1 billion in rebates to consumers this fall under” the ACA’s minimum Medical Loss Ratio provision, which requires individual and small group plans to spend 80% of the premium they collect on medical claims and large group plans to spend 85%. If they fall short of these numbers, the excess premium must be returned to their policyholders.

The MLR rebate amounts “are based on insurers’ experiences over the previous three years,” so the 2021 numbers do include 2020, which saw “a sharp reduction in health claims” due to medical office closures during the COVID-19 pandemic. The numbers do not, however, include 2018, when “insurers overpriced their ACA marketplace plans due to uncertainty caused by the repeal-and-replace debate.”

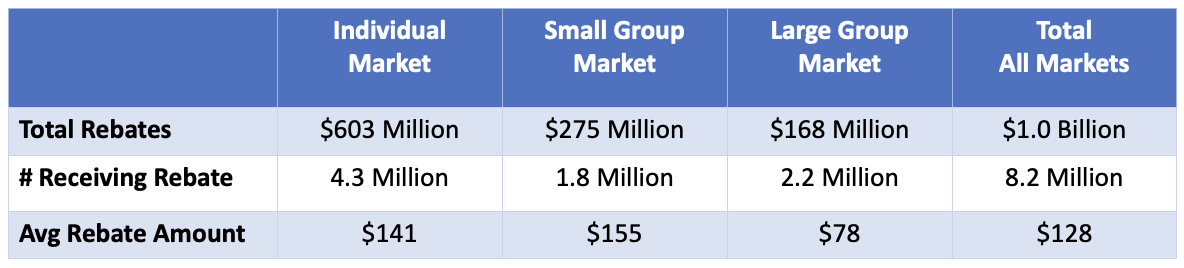

The second article, also from June 1, provides more information about the breakdown of the rebates: Of the $1 billion in expected rebates, 60 percent will be in the individual market. And of the 8.2 million people expected to receive a rebate, 4.3 million will be in the individual market. The average rebate amount per person receiving a rebate will be about $141.

Of the $1 billion in expected rebates, 60 percent will be in the individual market. And of the 8.2 million people expected to receive a rebate, 4.3 million will be in the individual market. The average rebate amount per person receiving a rebate will be about $141.

While these rebates indicate that plans are overpriced, that does not mean we will see a price decrease in the individual market next year. Here are a few things to consider:

- Not every insurance company will be sending out rebate checks. Yes, some insurers overpriced their plans, but others likely underpriced them.

- The 2021 rebates, paid out in the fall of 2022, are based on average claims over the past three years. For 2021, claims were actually up: “The average individual market loss ratio (without adjusting for quality improvement expenses or taxes) was 88%, meaning these insurers spent out an average of 88% of their premium income in the form of health claims in 2021.”

- Even if an insurer holds their rates from one year to the next, individual clients will pay more since they are a year older and all individual plans are based on the family members’ ages.

As further evidence that rates will not be decreasing, an early report from the Washington state insurance commissioner says that “Fourteen health insurers filed an average requested rate increase of 7.16% for Washington's individual health insurance market.” We’ll continue to learn about the rate increases requested in other states in the coming weeks. Of course, those requests must be reviewed and approved before becoming official.

One last thing to keep in mind is that the enhanced premium tax credits are set to expire at the end of 2022, so those receiving financial assistance will likely receive a smaller tax credit in 2023, causing their rates to go up.

The takeaway here is this: Some of your clients might receive rebate checks this fall, and that’s always good news. But you should let them know that they’ll likely see their rates go up for January 1, like always, and that these checks are not based on their individual utilization but rather a three-year average for the insurer’s entire block of business. The fact that they receive a check this year does not mean they should expect a rebate again next year.