Changes to Medicare Effective Dates

We want to point out a couple big changes to the Medicare effective dates for people who sign up during their Initial Enrollment Period (which begins three months before the month they turn 65 and ends three months after they turn 65) or during the General Enrollment Period (January 1 – March 31 each year). These changes went into effect beginning in 2023 and are detailed on this page of the Medicare.gov website.

Initial Enrollment Period

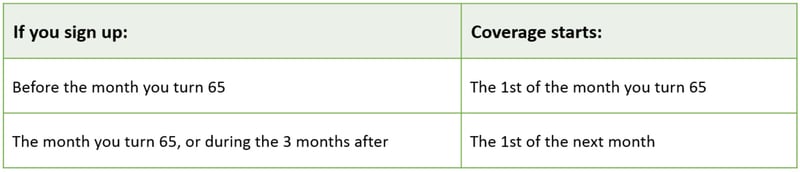

The Initial Enrollment Period, as the name implies, is the first opportunity people have to sign up for Medicare. Under the new rule, those who sign up before the month they turn 65 will have Medicare starting the first of the month that they turn 65 (unless their birthday is on the first of the month; in that case, coverage begins one month earlier). And those who enroll the month they turn 65, or anytime during the three months after they turn 65, will be effective the first of the next month.

This is an important change. In the past, those who signed up in the three months after turning 65 had a delay of one, two, or three months before their Medicare coverage would begin.

Medicare has a three-minute YouTube video that explains that Initial Enrollment Period. It might be worth sharing with your clients. The video explains whether people will receive Medicare automatically when they turn 65 or if they will need to sign up through the Social Security Administration. Here’s the link: https://youtu.be/XBeROFrweXU

General Enrollment Period

Those who do not sign up for Medicare during their Initial Enrollment Period and who do not qualify for a Special Enrollment Period can sign up during Medicare’s General Enrollment Period, which begins January 1 and ends March 31 each year. In the past, the effective date for anyone who signed up during the General Enrollment Period was July 1, but now, coverage is effective the first of the month after signing up. This is a big change. One thing that hasn’t changed, though, is that those who sign up during the General Enrollment Period because they delayed Medicare enrollment and who don’t have other creditable coverage may have to pay a late enrollment penalty.

Special Enrollment Period

Individuals who delay enrollment in Medicare might have an opportunity to sign up during a Special Enrollment Period (SEP) and avoid paying a late enrollment penalty. This often occurs when someone loses job-based coverage, but there are other situations that will qualify someone for an SEP. Those are detailed on the Medicare.gov website. Note that the effective date for Medicare Part A is backdated by up to six months for Medicare beneficiaries who sign up after their Initial Enrollment Period. This could impact their HSA eligibility, so they might need to adjust their contributions the year they sign up for Medicare.

Medicare Alone Is Not Enough

As we all know, Medicare has some pretty big holes in it, so most beneficiaries sign up for a Medicare Advantage plan or purchase a Medicare supplement to reduce their out-of-pocket exposure. These products have their own enrollment periods as well, and they haven’t changed. To learn more about the Medicare products AHCP offers to help you help your clients, be sure to visit our website.