Medicare 101

In just a few weeks, the Annual Election Period for Medicare Advantage and Medicare Part D plans will open, and when it does agents who had intended to start selling Medicare products this year, perhaps because of the instability in the individual market, but who failed to get certified to sell those products will have missed their opportunity. Sure, they can still sell supplements all year long, but the big opportunity that comes only once a year will be behind us and they’ll have to wait until October, 2018 for their next chance.

To help those of you who are still deciding whether to expand your portfolio to include Medicare-related products or not, we thought we’d provide a short “Medicare 101” tutorial. And for those of you who already sell Medigap policies, Medicare Advantage plans, and Medicare Part D prescription drug plans, this should serve as a nice refresher. Since it’s often necessary to educate clients and prospects about what they currently have before explaining what their options are, knowing how to do that in concise terms may prove helpful. Here we go...

What is Medicare?

Let’s start off with the basics – what, exactly, is Medicare? Put simply, Medicare is a government-run health insurance program for people over the age of 65, people receiving Social Security Disability payments, and people with End Stage Renal Disease (kidney failure requiring dialysis).

Medicare was signed into law back in 1965 and was originally created for older Americans who had trouble qualifying for insurance at the time. Over the years, Medicare has been modified on a number of occasions. In 1972, for instance, it was expanded to include the disabled and people with ESRD. In 1997, President Clinton signed the Balanced Budget Act, which created the Medicare + Choice program (now called Medicare Advantage). In 2003, President Bush signed the Medicare Drug, Improvement, and Modernization Act, which created the Medicare Part D drug program and expanded funding for Medicare Advantage. And the Affordable Care Act, signed into law in 2010 by President Obama, added a number of new preventive services to the program and began to close the unpopular Part D donut hole.

While many lawmakers believe Medicare needs some serious improvements, others would like to expand the program to include those age 55 and older or even to cover all Americans. The government program does have a high approval rating among those who receive Medicare benefits.

There are two parts to original Medicare: Part A and Part B. One is paid for through payroll deductions during your working years; the other is paid for when you sign up for Medicare benefits.

Medicare Part A

Medicare Part A is known as “hospital coverage,” though it actually helps pay for a number of different services:

- In-patient hospital facility charges

- In-patient skilled nursing facility care

- Home health care

- Hospice

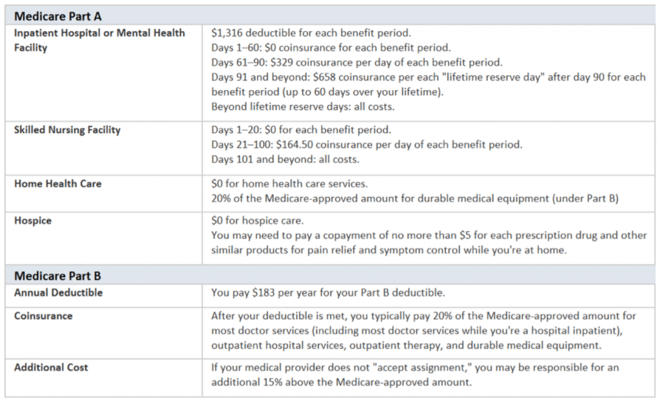

There are various deductibles and copayments required when people use Medicare Part A, including a big up-front deductible for hospitalization and daily charges after 60 days.

Most people over age 65 qualify for “premium free” Medicare Part A. That’s because they’ve contributed to the program through payroll deductions for at least 40 quarters, the equivalent of 10 years, or they are married to someone who has. Those who did not contribute to the program for the required amount of time must pay a monthly fee when they sign up.

Interestingly, after age 65 Medicare Part A is mandatory for anyone receiving social security. In other words, you can’t postpone or opt out of Part A without also forfeiting your social security payments. There was even a court case challenging this requirement, but the judge ruled against the plaintiffs.

Medicare Part B

Medicare Part B is known as “Medical Insurance” and covers a number of services, including:

- Doctor charges (in or out of the hospital)

- Preventive care

- Outpatient surgery

- Durable Medical Equipment

- Diagnostic Tests

- Outpatient chemo, radiation, and dialysis

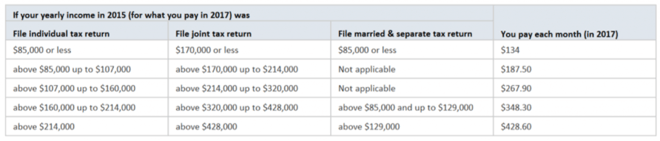

Unlike Medicare Part A, which people pay for during their working years, Medicare Part B is paid for when you actually start receiving the benefits. For 2017, the standard Medicare Part B premium is $134, but it can be more or less than this amount. Most people already receiving Medicare Part B prior to 2017 and paying for it through a deduction from their social security checks, for instance, pay $109 per month. People with higher incomes, though, pay significantly more for Medicare Part B. The below chart from Medicare.gov shows the income adjustments to the Part B premiums.

For Medicare Part B, there’s an annual deductible to meet, and then people pay 20% of the Medicare allowed amount with no stop-loss protection.

Lots of Holes

We’ve already mentioned some of the “holes” in the Medicare Part A and Part B coverage, but there are actually several other gaps that can require beneficiaries to spend a lot of money out of pocket when they do need medical care. Here’s a quick summary of the Medicare cost-sharing requirements:

Source: Medicare.gov

Medicare Supplements

Looking at the holes in Medicare Parts A and B, it’s pretty clear that many people may need some additional protection. To help fill the gaps in Medicare, some people purchase a Medicare Supplement, also known as a Medigap policy. Medicare supplements pay secondary to Medicare and cover some of the out-of-pocket expenses after Medicare has paid its share.

When someone with a Medicare supplement receives medical services, she presents both her red, white, and blue Medicare card and her Medicare supplement card. The provider will bill Medicare, which will pay its portion of the bill. Afterwards, the supplement will pay the portion that it is responsible for. In some cases, Medicare will even notify the insurance company so that the provider does not have to.

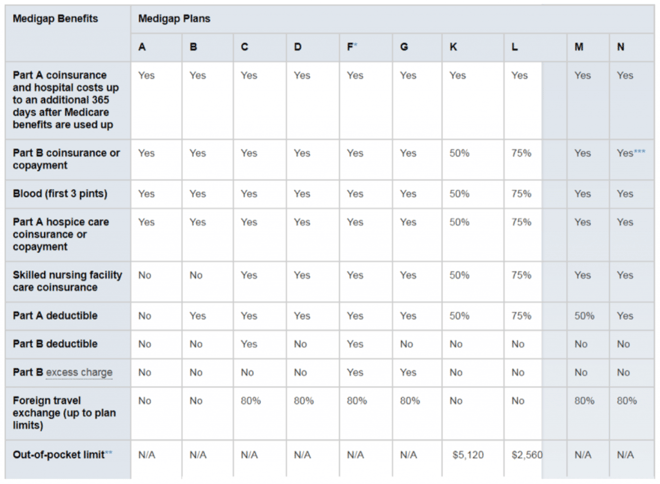

There are 10 standardized Medicare supplement policies, each designated by a different letter. Different supplements fill different holes in the Medicare coverage, but a plan from one company will fill the same holes as a plan with the same letter from another company. The standardization makes it easy to compare policies from one insurance company to another. Instead of reading the fine print and looking for

hard-to-find differences in the benefits, agents and their clients can focus on the premium, rate history, and financial ratings of the plans when making a decision.

The below chart shows the various Medigap options and what expenses they cover.

Source: Medicare.gov

If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies are standardized in a different way.

* Plan F also offers a high-deductible plan. If you choose this option, this means you must pay for Medicare-covered costs up to the deductible amount of $2,200 in 2017 before your Medigap plan pays anything.

** After you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year.

*** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

For the first six months after a beneficiary starts receiving Medicare Part B, he or she cannot be turned down based on medical conditions, so clearly this is the best time to

sign up for a Medigap plan. After that six-month window, insurers can underwrite the policies and can decline coverage based on pre-existing conditions.

Medicare Part D

What you may have noticed is that neither original Medicare (Parts A and B) nor any of the standardized Medigap policies cover prescription drugs. That’s because, until fairly recently, the Medicare program did not pay for medications outside of the hospital. Think about that for a second—the population that has the highest number of chronic conditions and therefore the greatest need for medication did not have coverage for prescription drugs under their health program until 2006. Before that time, some seniors living on a fixed income often had to make the difficult choices in spending if they needed medications. Clearly, they needed some help. That’s why, in December of 2003, President Bush signed the Medicare Modernization Act and created the Medicare Part D drug program.

Under Medicare Part D, people get help paying for the medications they need. In most parts of the country, there are a number of plans to choose from, each with different drug formularies, required copayments, and monthly plan premiums. Many require the member to pay an annual deductible before the drug coverage kicks in, and almost all have a “coverage gap,” sometimes referred to as a donut hole, after the total drug costs exceed a certain amount. The coverage gap has gotten smaller as a result of the Affordable Care Act, but it’s still something that many seniors fear.

The interesting thing about the Medicare Part D program is that the government doesn’t actually offer any of the available drug plans; instead, they’re offered by private insurance companies. This unique approach has led to more options for consumers, and the competition has helped to keep premiums down.

Medicare Part D can be offered as a stand-alone plan to pair with original Medicare (and a supplement) or can be incorporated into a Medicare Advantage plan, discussed below.

Medicare Advantage Plans

Medicare supplements are great. They fill many of the holes in an individual’s Medicare coverage, giving them financial peace of mind, and they allow beneficiaries to visit any provider that accepts Medicare. Unfortunately, though, not everyone can afford a Medicare supplement. That’s where a Medicare Advantage (MA) plan can help.

Medicare Advantage plans are offered by private insurance companies that take over for Medicare. While a supplement simply fills the holes in Medicare, an Advantage

plan actually replaces Medicare. While a beneficiary is on an Advantage plan, he won’t use his Medicare card; instead, he’ll show his MA insurance card when he visits the doctor or goes to the hospital. If his Advantage plan has Medicare Part D built into it (a Medicare Advantage Prescription Drug Plan, or MAPD for short), he’ll show the same card when he picks up his monthly prescriptions.

Medicare Advantage plans look a lot more like the insurance sold in the individual and group markets. There are several different types of plans, including HMOs and PPOs, and most have copayments for lower-cost services, deductibles and coinsurance for higher-cost services, and an out-of-pocket maximum that limits the member’s financial exposure. Most also have contracted provider networks and offer the best benefits when members visit in-network providers.

One type of Medicare Advantage plan, called Private Fee for Service (PFFS), does not contract with providers but instead pays a pre-determined amount for covered services. Providers do not have to treat patients with this type of coverage, so it’s important for members to talk with their providers ahead of time to make sure they’re willing to treat them and accept the plan’s payment terms.

There’s no underwriting on a Medicare Advantage plan. As long as the Medicare beneficiary has both parts A and B, lives in the plan’s service area, and does not have End Stage Renal Disease, he or she qualifies for an Advantage plan. These plans also have a much lower monthly premiums than a Medicare supplement, sometimes with no additional cost beyond the Medicare Part B premium. The downside is that the out- of-pocket exposure is usually a little higher than with a supplement, and Medicare Advantage plans come with network restrictions that supplements do not.

Annual Election Period

That brings us to the Annual Election Period, or AEP, which runs from October 15 to December 7. This is the time of the year when people can join, switch, or cancel their Medicare Advantage and Medicare Part D plans. Agents who sell these products spend weeks preparing for the craziness, completing the various training and certification programs required by their states and the carriers they represent.

The most successful brokers also plan their time well. They know that it’s a hectic time of the year and they must figure out a way to visit with as many people as possible while giving each one the time and attention that he or she deserves. It can be a lot of work, but it can also very rewarding.

Broker Compensation

If you’ve made it this far, you’re probably wondering how big of an opportunity this actually is. That can be answered in two ways.

Currently, there are more than 55 million Americans with Medicare according to CMS, and the Washington Post reports that 10,000 people turn 65 every day. That means that you literally have millions of prospects to call on! This is an opportunity that won’t go away anytime soon.

As for compensation, it varies by carrier and product, but here are some numbers from CMS to give you an idea about how much money you can make:

|

Product |

Year 1 Commission |

Renewal Commission |

|

Medicare Advantage |

$455 Initial Enrollees $228 Replacement |

$228 |

|

Medicare Supplements |

$250 |

$250 |

|

Medicare Part D |

$72 |

$36 |

Additionally, Medicare clients tend not to hop from product to product every year, which means that your persistency should be pretty good—sell it once and you could get paid for several years.

If you do the math, you can see that Medicare is a great market with a lot of potential for agents who are looking to grow they business and increase their income. Are you one of those agents?

AHCP Can Help!

At America’s Health Care Plan, we work with leading Medicare Advantage and Medicare Supplement providers across the country. While we offer dozens of carrier options, you’ll find our leading Medicare partners on our website here. If you’d like to get appointed with them or if you need information on the training and certification requirements, please let us know. We’re here to help.

Want to learn more?

While we covered a lot in this article, the truth is that we’ve really only scratched the surface. To learn more, check out the 2017 edition of the Medicare & You handbook. It provides great information for Medicare beneficiaries but can also be invaluable for agents who are interested in offering Medicare-related products. If you haven’t already reviewed the latest Medicare Marketing Guideline, we strongly encourage you to familiarize yourself with these well in advance of AEP.