Big Increase in Medicare Premiums, Cost Sharing

The Medicare Annual Election Period just ended, and chances are that you got an earful from clients about next year’s Medicare Part B premium. While the amount consumers pay for Medicare Part B goes up every year, the 2022 increase is unusually large—about 15 percent.

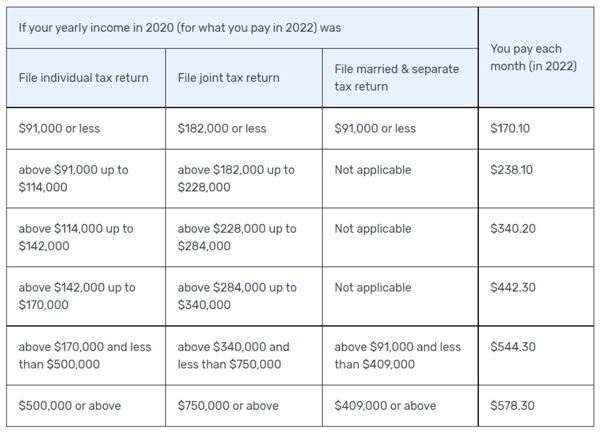

The standard Part B premium will be $170.10 in 2022, up from $148.50 in 2021. That’s an increase of more than $20 per month, which is a big deal for seniors living on a fixed income. Those with higher incomes will see a big jump too. The Part B premium people pay is actually based on their income two years prior, so the 2022 premiums will be determined by what beneficiaries earned in 2020. The chart below from the Medicare.gov website shows the standard premium as well as the premiums for those who must pay the Income-Related Medicare Adjustment Amount, or IRMAA:

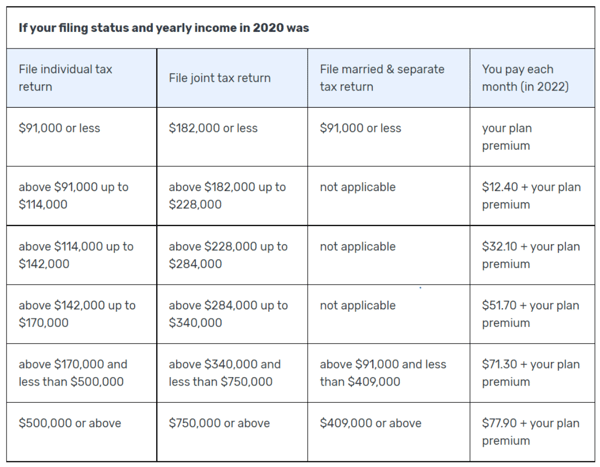

The same folks who must pay more than the standard amount for the Part B premium must also pay an additional amount for Medicare Part D as well.

The same folks who must pay more than the standard amount for the Part B premium must also pay an additional amount for Medicare Part D as well.

The other notable increase for 2022 is the cost-sharing amount for Medicare Part B. The Part B deductible, which was $203 in 2021, is increasing to $233 in 2022—another 15 percent increase. Remember, with Medigap Plan F no longer available for people who aged into Medicare after December 31, 2019, everyone with a Medicare Supplement must pay the Part B deductible when they first receive medical care each year.

The increases for some of the other Medicare out-of-pocket costs are not as significant. For instance, the Part A deductible is increasing by about five percent, from $1,484 to $1,556 per benefit period. The copays after day 60 and after day 90 in the hospital are also increasing by just under five percent.

Again, you can view all Medicare premium and cost-sharing amounts on the Medicare Costs At A Glance page of the Medicare.gov website.

Remember, these cost-sharing increases, while significant, only highlight the need for coverage in addition to original Medicare, whether that’s a supplement to fill in the holes or an Advantage plan to take over the administration for Medicare. You can find all of AHCP’s Medicare solutions on the carrier page of our website.