The Enhanced Premium Tax Credits are Substantial

It’s been a few months since the Biden Administration announced the increase in the premium tax credits for individual health plans under the American Rescue Plan Act (ARPA), so hopefully you’re busy helping clients take advantage of the increased financial assistance. If not, we wanted to stress to you just how significant this assistance can be for certain individuals.

For those who missed it, there are several big changes to the premium tax credits, and these changes are expected to last through the end of 2022. As Kaiser Health News (KHN) explains, “how much people owe is reduced at every income level and capped at 8.5% overall.” Here’s a quick summary of the four biggest changes:

- While ARPA “increases premium tax credits for all income brackets for coverage years beginning in 2021 and 2022” according to CMS, KHN explains that people with incomes below 150% of the federal poverty level (FPL), or about $19,140 for a single person in 2021, “will owe nothing in premiums. Under the ACA, they had been required to pay up to 4.14% of their income as their share of the premium cost.”

- At the other end of the income spectrum, people who earn between 300 and 400% of the federal poverty level (FPL) will also see their tax credit increased. As CMS explains, no one will pay “more than 8.5% of their household income towards the cost of the benchmark plan or a less expensive plan.” The benchmark plan is the second-lowest-priced silver-level plan in the marketplace, and it’s the plan that’s used to determine the premium tax credit amount. Before this change, the capped amount was determined on a sliding scale that went all the way up to 9.83% of the household income.

- Additionally, CMS notes that the “subsidy cliff” for those earning more than 400% of the FPL has been eliminated, and now they will also pay no more than 8.5% of their household income for the benchmark plan. This is huge and could result in thousands of dollars in savings for some families who previously received no financial assistance.

- Finally, KHN explains that “anyone who has received unemployment benefits this year will be considered to have income at 133% of the federal poverty level (about $17,000) for the purposes of calculating how much they owe in premium contributions for a marketplace plan.” And, because “people with incomes up to 150% of the poverty level don’t owe anything in premiums under the new law, these unemployed workers can get a zero-premium plan.” At this assumed income level, these individuals would also be eligible for cost-sharing reductions if they buy a silver-level plan.

Those are all big reasons to be reaching out to your current and prospective individual clients. Those already receiving a subsidy will need to log into their healthcare.gov account to update their applications in order to receive the increased tax credit. State-based marketplaces may also require this, though in some states the increase may happen automatically. If you have clients with off-exchange plans, they will need to re-apply through the marketplace in order to receive a subsidy.

Looking at the Numbers

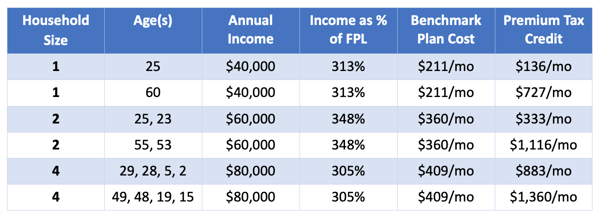

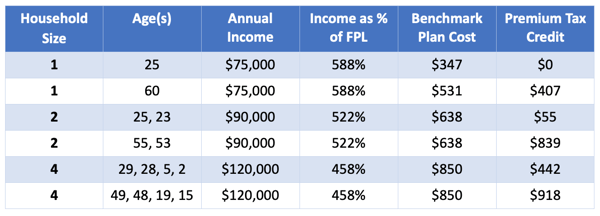

It’s one thing to hear about the enhanced tax credits, but for some people it makes more sense when they see some examples. Below are some calculations of the tax credits available for different ages, income levels, and household sizes. The cost shown for the benchmark plan is the member’s cost after applying the premium tax credit. We used Jacksonville, Florida as the location.

As you can see, people with the same income level and household size are capped at the same amount for the benchmark plan, but the premium tax credit, which is the difference between the total premium and the capped amount, is significantly higher for older individuals than younger individuals with the same income. Some younger individuals with higher incomes will receive no tax credit if their total premium is below the capped amount.

All calculations are determined using the Kaiser Family Foundation’s Premium Tax Credit Calculator. You may want to take a look and run some numbers for yourself.

People earning less than 400% of FPL

People earning more than 400% of FPL (no tax credit was available before ARPA)

Some People Qualify for Free Coverage

Keep in mind that nobody is required to purchase the benchmark plan; it’s simply used to determine the premium tax credit amount. Once determined, the tax credit can be used to purchase any plan in the marketplace. Because bronze-level coverage is much less expensive than silver-level coverage, the premium tax credit will be enough to cover the full premium for a bronze-level plan for many people. In other words, millions of Americans could qualify for free coverage after applying the tax credit.

Diminishing Barriers to Care

Health insurance is a necessity. We all know that. Unfortunately, as we also know all too well, health insurance is very expensive, so many people make the difficult decision to remain uninsured. Not only does this decision expose them to big medical bills if they have a serious illness or injury, the lack of health insurance might prevent them from receiving the care they need. That’s because health insurance helps people to access medical care; without it, people’s choice of providers and ability to receive non-emergency treatment is very limited.

Whatever your thoughts are on the American Rescue Plan Act and our ability as a country to pay for all of the assistance it provides, the fact is that it is now law and the enhanced tax credits are available to help your clients and prospects.

Since nearly everyone without job-based or government-provided coverage now qualifies for a premium tax credit—a significant tax credit in many cases—there’s really no reason agents shouldn’t be able demonstrate to people the value of having coverage. After all, we are salespeople, and we have a product that 1) people need and 2) might be able to get at no cost. We just need to tell them about it.