New People Are Signing Up For Marketplace Coverage

In the insurance industry, we all know that the main reason to purchase health insurance is because we’re unable to predict the future. Unexpected and potentially catastrophic injuries and illnesses do happen, and when they do, people with health insurance tend to fare much better financially than those without.

The Affordable Care Act (ACA) created some additional incentives to purchase health insurance:

- Plans are guaranteed issue, meaning your clients can’t be turned down.

- Pre-existing conditions are covered with no exclusions, waiting periods, or surcharges.

- Premium tax credits help people with incomes up to 400% of the federal poverty level pay their monthly premiums.

- Cost sharing subsidies reduce the out-of-pocket exposure for those with incomes below 250% of the federal poverty level.

- Essential Health Benefits ensure that today’s plans meet people’s needs.

Yet, some people dismiss all of these great reasons and choose instead to remain uninsured.

Enrollment is Stagnant

We’re now in the ACA’s fifth annual open enrollment period, and many people have observed that enrollment hasn’t increased all that much since 2014. That leads many to conclude that anyone who is going to purchase an individual health plan already has one, and most enrollments are simply a result of moving people from one plan to another. With today’s rising premiums and an ever-changing marketplace, people really should evaluate their coverage options every single year.

What Brokers Need to Know

Even if nobody new is signing up, there is a real opportunity for agents to help those who already have coverage. Remember, several carriers made the decision to stop offering Marketplace coverage for 2018. Others made big changes to their plan designs. And most insurers, correctly anticipating a change to the cost sharing reduction payments, raised the prices on their silver level plans. The combination of these factors means you should guide clients in determining whether their current plan will continue to be the best option for them in 2018.

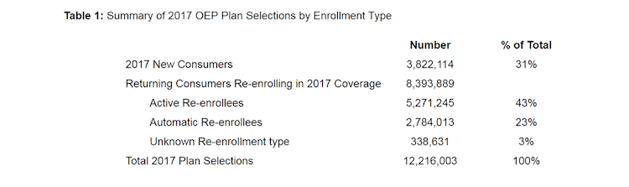

Second, the assumption that nobody new is signing up appears to be incorrect. In March, CMS reported on the final enrollment numbers for the 2017 Open Enrollment Period. Interestingly, 31% of consumers were new to the Marketplace, as shown in the table below.

This means that there is, in fact, an opportunity for brokers to find new clients needing health insurance and who may qualify for financial assistance to sign up for coverage through the federal or state Marketplaces. In other words, while overall enrollment may be fairly stagnant, some people renew their existing Marketplace plan each year. Others move to a different plan, others drop their coverage for one reason or another, and some people sign up for the first time.

This year is a little different, though. As you know, the enrollment period is chopped in half. Instead of the normal three months, your clients only have six weeks to select a plan and get signed up. Also, the big cuts to the federal advertising budget have definitely had an impact. As the Kaiser Family Foundation reports, fewer people say they’ve seen advertisements for open enrollment than in past years, and a majority of non-group enrollees are unaware of the timing of open enrollment.

In short, brokers have their work cut out for them this year, but there is definitely an opportunity. People need help, so it’s time to do what you do.