Medicare Changes for 2019

Each year, Medicare makes changes to the Part A and B out-of-pocket expenses, monthly premium for Part B, and premium adjustment thresholds for Part B and Part D. Here are the figures for 2019.

Cost Sharing

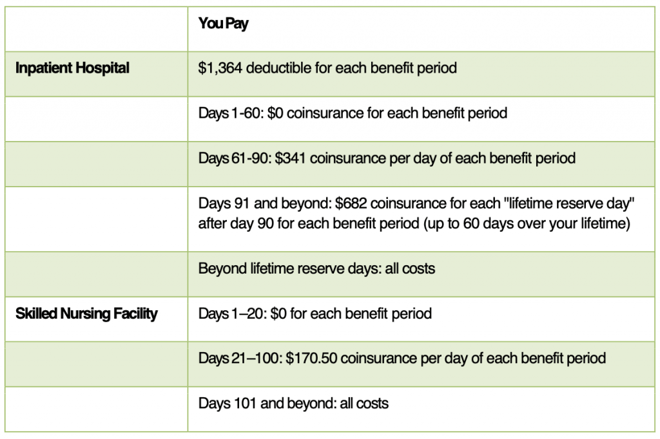

Medicare Part A requires beneficiaries to pay a portion of the cost of hospital and skilled nursing stays.

Medicare Part B requires beneficiaries to pay a calendar-year deductible. For 2019, the Part B deductible is $185 per year. After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and durable medical equipment.

Monthly Premiums

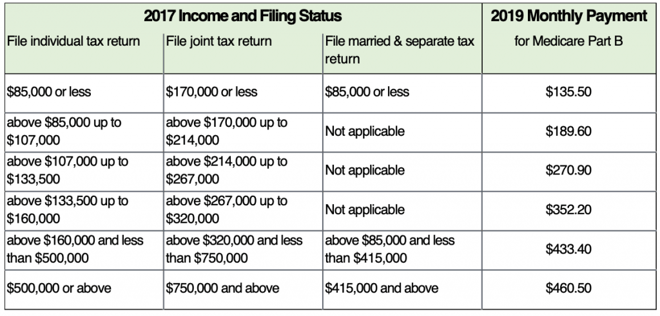

The standard Part B premium for 2019 is $135.50, just slightly higher than the standard premium of $134 in 2018. However, the premium can be higher based on the individual’s income two years ago. Below are the Part B income adjustment thresholds for 2019.

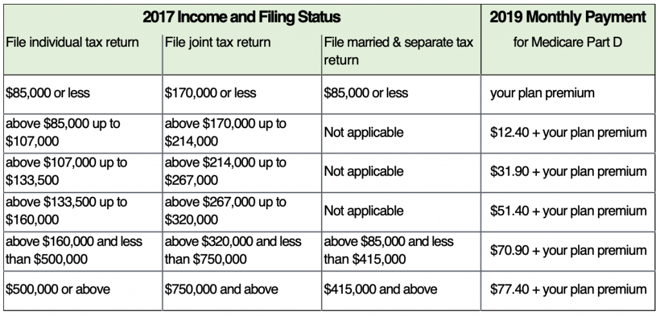

Similarly, there is a Medicare Part D premium adjustment for high income individuals. Just like Part B the adjustment for 2019 is based on the individual’s income in 2017.

Source for premium and cost-sharing information: https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance

Two Other Changes for 2019

In addition to the annual premium and cost-sharing adjustments, there are two other important Medicare changes for 2019.

Medicare Advantage Open Enrollment Period: As we discussed in an October 2018 blog post, the “Medicare Advantage Open Enrollment Period” is back for 2019. During this time (January 1 – March 31), Medicare recipients can switch from one Medicare Advantage plan to another Medicare Advantage plan (with or without prescription drug coverage) or return to original Medicare and purchase a prescription drug plan.

Last Year for Plan F Supplements: As a reminder, 2019 is the last year that new Medicare recipients will be able to purchase a Medigap Plan F supplement. Beginning in 2020, people who already have Medicare can still purchase a Plan F supplement, but new beneficiaries will not have this option. For the new beneficiaries, Medigap Plan G will be the most comprehensive supplement available. To learn more, look at our December 2018 blog post on this topic.