IRS Announces HSA Limits for 2017

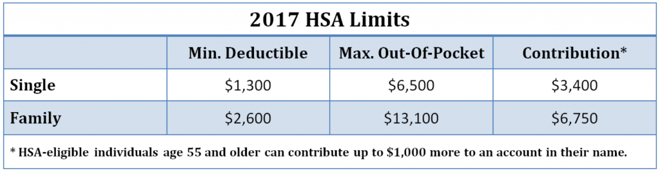

The IRS recently announced the new HSA contribution, deductible, and out-of-pocket limits for 2017, and not much is changing. In fact, the only change is to the individual contribution limit: it’s increasing from $3,350 to $3,400. Everything else is staying the same.

What’s interesting is that the out-of-pocket limits for non-HSA-qualified ACA plans are not staying the same; in fact, they’re increasing significantly. The 2017 individual out-of-pocket maximum for ACA plans will be $7,150 (up $300 from $6,850 in 2016) and the family out of pocket maximum will be $14,300 (up $600 from $13,700 in 2016).

What this means, of course, is that we’re likely to see more high deductible plans next year that don’t actually meet the definition of a High Deductible Health Plan. Instead of being the lowest-priced plans in the market, as we would expect, HSA-qualified plans will offer significantly better coverage than some non-HSA plans that don’t offer up-front copayments for doctor visits and prescriptions.

When we combine the fact that many plans; 1) may have a higher out-of-pocket exposure than most people are comfortable with, and 2) may have a reduced provider network with no out-of-network coverage. Many consumers will fail to see the value, but unfortunately, it may be all that some people can afford.

Before pointing your clients to the lowest-priced plans in the market, be sure to show them the HSA options as well. Given the high out-of-pocket exposure on most of today’s plans, the ability to pay with pre-tax dollars will be attractive to many individuals and well worth the additional premium.