Insurance: Rocket Science or Basic Math?

As you know all too well, most people find health insurance confusing. Very confusing. Otherwise intelligent people seem completely baffled by deductibles, copayments, and coinsurance, and they frequently use the terms interchangeably. There have been surveys that find people would rather have a root canal than shop for health insurance—to them, it would be less painful.

This, of course, presents a challenge for brokers who need their clients to understand their options so they can select the plan that is best for themselves and their families.

Maybe the secret is to tell clients that they’re not alone—most people find health insurance confusing. That said, health insurance isn’t rocket science, and they can use some basic math to find the right coverage at the right price. Perhaps some examples would help.

HSA vs. Copay Plan

One of the major decisions people have to make when shopping for health insurance is whether to go with a copay plan or an HSA-compatible plan without the up-front copayments. And the best way to explain the difference between these two options is to compare similar plans, one with copayments and one without.

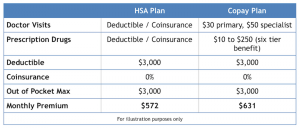

Here’s a sample quote from a typical major health carrier that illustrates this point:

As you can see, both plans have the same deductible and out-of-pocket maximum. They also use the same provider network. The main difference between the two options is that one plan has copayments for doctor visits and prescriptions while those services are subject to the deductible and coinsurance on the other plan.

This clearly shows that the cost of adding up-front copayments to the plan is $59 per month or $708 per year. The copay plan is 10.3% more expensive than the HSA plan, and a client who selects the copay plan will have to pay for medical expenses with after-tax dollars.

HMO vs. PPO plan

Another big decision that people have to make when shopping for health coverage is whether to go with a smaller HMO network or a larger, less restrictive PPO network. While the PPO is preferable for many people, the price difference can be significant.

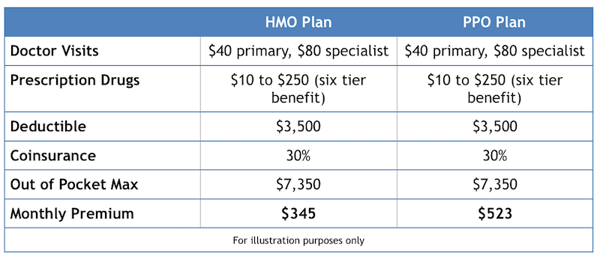

Below is a sample comparison from a typical major health carrier of two similar plan options. The difference is that one plan uses an HMO network and one uses a PPO network.

In this example, we compare the cost of two similar copay plans. They have the same in-network deductible, coinsurance, and out-of-pocket limit, and the copayments for doctor visits and prescriptions are also the same. The difference is that the PPO plan offers a larger provider network and an out-of-network benefit.

The cost difference between the two options is significant: The PPO will cost the member an additional $178 per month or $2,136 per year. That equates to a 51.6% surcharge to upgrade from the HMO to the PPO.

High vs. Low OOP Limit

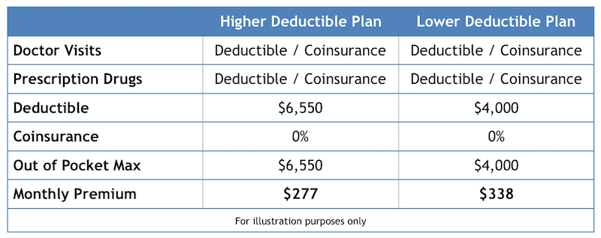

Our last comparison will take a look at the cost of reducing the out-of-pocket exposure for the member. We compare two sample HSA-compatible HMO options, one with a $6,550 out-of-pocket limit and one with a $4,000 out-of-pocket limit.

These two options are priced significantly lower than comparable copay plans or PPO options, so a client looking to save some money might be interested in one of these two plans. The question is whether it’s worth the additional cost to reduce the out-of-pocket exposure from $6550 to $4,000. The cost to do so is $61 per month, but for this analysis the annual figure is more useful. The extra cost to reduce the in-network exposure by $2,550 is only $732.

Whether it is worth the extra cost will depend on the client’s budget and the likelihood that the member will have a big claim or not, but clearly someone with a planned surgery or someone who is expecting a baby may want to pay a little more to reduce the out-of-pocket costs.

Closing Thoughts

In this post, we’ve examined three decisions your clients have to make when choosing a plan:

- Is it worth the extra cost to cover doctor visits and prescriptions for predictable, up-front copayments?

- Is it worth the extra cost to have a larger provider network with out-of-network benefits?

- Is it worth the extra cost to reduce the plan’s out-of-pocket exposure?

These are questions that only your clients can answer, but if they are having trouble reading a plan grid with dozens of plan options, perhaps it would be helpful to compare two plans at a time, ask them each of these questions, and let them use some basic math to narrow down their options and make a buying decision.