How to Determine When Medicare is Primary

About a year ago, we posted an article about Medicare Premium Reimbursement Arrangements, which allow small employers to pay for the Medicare Part B, Part D, and supplement premiums for their active employees. As explained in the article, the employer cannot force older employees off of the group plan (they have the same enrollment rights as all other full-time employees), but it can often be a win-win solution for both the employer and the employee.

The one caveat mentioned in the article is that this strategy only works when Medicare is primary. The Medicare Secondary Payer (MSP) rules kick in when a group has 20 or more employees (full- and part-time), and the MSP rules prohibit an employer from incentivizing an employee to drop off the group plan and sign up for Medicare.

So that raises a couple questions about timing:

- If a company has recently grown to more than 20 employees, at what point is the group plan considered primary to Medicare?

- If a company has recently dropped below 20 employees, when is Medicare considered primary again?

The answer to both of these questions can be found in a 2017 training course developed by CMS. The course discusses employer size as it relates to MSP for working age adults, people with a disability, and people with ESRD (end-stage renal disease). Some of those topics are beyond the scope of this article, but it is worth reviewing the CMS slides if you market either group or Medicare-related products.

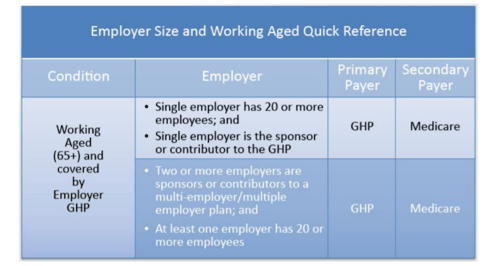

As the course explains, “Medicare is the secondary payer to GHPs (group health plans) for the working aged where either a single employer of 20 or more full and/or part-time employees is the sponsor of the GHP or contributor to the GHP, or two or more employers are sponsors or contributors to a multi-employer/multiple employer plan, and a least one of the employers has 20 or more full and/or part-time employees.”

That does not answer our question about timing, though. How soon after a company crosses that 20-employee threshold does MSP apply, and how soon after a company drops below 20 employees will Medicare be considered primary to the group health plan? That answer is found in the slide notes later in the presentation:

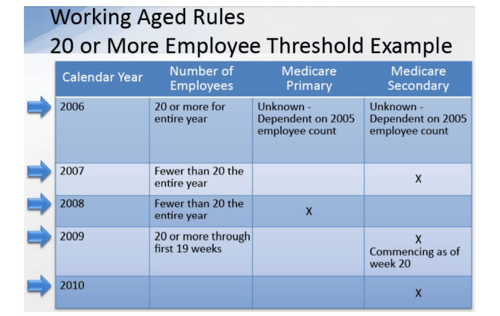

- For the purposes of determining the 20 or more employee threshold under the Working Aged rules, full-time and part-time employees must be included.

- The 20 or more employee requirement is met if the employer employed 20 or more employees for each working day in each of 20 or more calendar weeks in the current or preceding year. The 20 weeks do not have to be consecutive.

- The requirement is based on the number of employees, not the number of people covered under the plan.

- Employers who did not meet the requirement during the previous calendar year may meet it at some point during the new calendar year, and at that point Medicare would become the secondary payer for the remainder of that year and through the next year.

- An employer is considered to have 20 or more employees for each working day of a particular week if the employer has at least 20 full and/or part-time employees on its employment rolls each working day of that week.

- An individual is considered to be on the employment rolls even if the employee does not work on a particular day.

- Self-employed individuals participating in a GHP are not counted as employees for purposes of determining if the 20 or more employee requirement is met.

To help clarify the rules, CMS provides the following example:

Again, knowing when the MSP rules apply is important for agents recommending a Medicare Premium Reimbursement Arrangement to their small group clients. This can be a great strategy to save small employers money, but it only works when Medicare is primary to the group health coverage.