Done for You! A Medicare Explainer Email Template

One of the challenges of selling Medicare products is getting clients up to speed on how the program works so they can evaluate their options and make a decision. In other words, it’s not as simple as giving them the rates for a few supplements or explaining the features and benefits of three different Advantage plans; instead, for beneficiaries new to Medicare, agents usually have to educate clients about what Medicare A and B are, how to sign up, how much they cost, and what type of options are available in addition to Original Medicare. That takes time.

The good news is that the basic conversation is the same for most clients, which means that agents can create a template that they can use again and again. But, instead of needing to create a template, we have one to share with you. The below email was created by Eric Johnson, an agent in Texas. He said to feel free to make any changes you’d like and then use it with your own clients.

Our suggestion would be to copy the below text into an email, edit it to make it your own, and then save it as an email template. You can learn more about email templates in this 2018 article.

This email would be good for clients who currently have a group or individual plan and are aging into Medicare.

Subject Line: Your Medicare Options

Hi ____,

You will soon be eligible for Medicare, so I wanted to send you an email explaining your options and detailing the steps you need to take to have your coverage in place by ____. Once you’ve had a chance to review this and are ready to talk, please let me know and we can set up a call.

Signing Up for Medicare

You turn 65 in June, so your Medicare coverage will start June 1 (the first of the month in which you turn 65). If you’re already receiving Social Security benefits, then you should receive your Medicare card in the mail sometime soon. But if you’re not currently receiving Social Security benefits, you’ll need to apply for Medicare coverage. So that’s the first step. The good news is that it’s pretty easy, and you have a couple options:

-

- You can log onto www.ssa.gov to sign up for Part A and Part B of Medicare. When you are at the home page, select the box for retirement benefits. This selection allows you to sign up for Medicare and/or Social Security benefits.

- You can contact the Social Security Administration at 1.800.772.1213 to enroll over the phone or schedule an in-person appointment.

You’ll need both Parts A and Part B to obtain either a Medicare Supplement or a Medicare Advantage plan. Those are explained below.

Understanding Original Medicare (Parts A and B)

Medicare is a government program for people over the age of 65, people on Social Security Disability, and people with End-Stage Renal Disease (ESRD).

It is not a handout; instead, it’s something you’ve paid for during your working years and something you’ll pay for when you turn 65 and begin receiving benefits.

When you’re working, 1.45% of your income goes to pay for Medicare Part A (2.9% if you’re self-employed). When you turn 65, Part A is free as long as you’ve contributed to the Medicare program for 40 quarters (10 years), or if you’re married to someone who’s contributed for that amount of time, but you’ll continue to pay the 1.45 (or 2.9) percent your income as long as you’re working.

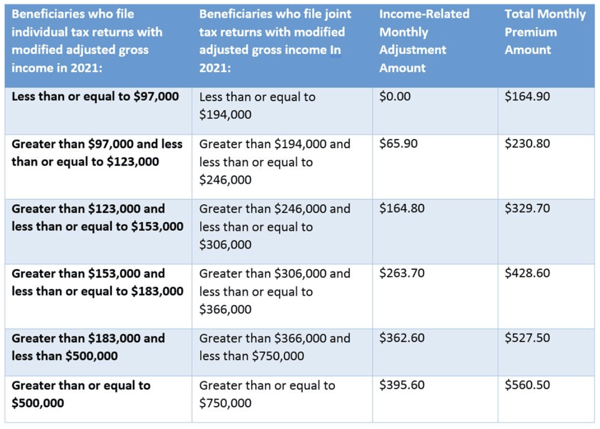

Part B of Medicare is something you pay for when you start receiving it. The amount you pay depends on what your income was two years ago, so the 2023 premium is based on your 2021 income. Here’s a chart that shows you the amounts:

Unfortunately, Medicare alone is not enough. Medicare Part A (which covers hospital facility costs, skilled nursing facilities, home health, and hospice) has a big hospital deductible of $1,600 that can hit multiple times in a year, copayments of $400 per day after day 6, copayments of $800 per day after day 90, and no coverage at all after 150 days in the hospital. These are the 2023 amounts – they go up every year.

For Part B of Medicare (which covers doctor visits in or out of the hospital and outpatient services like rehabilitation, chemo, radiation, dialysis, and medical equipment), has an annual deductible of $226, then you pay 20% of the bill after that with no out-of-pocket limit – the 20% goes on forever.

To help reduce your risk, you need something other than original Medicare. There are two options, a Medicare Advantage plan or a Medicare supplement, also called a Medigap plan.

Medicare Advantage Plans

A Medicare Advantage plan is basically a health plan offered by a private insurance company that takes over the administration of your Medicare benefits. When you sign up for an Advantage plan, you won’t use your Medicare card when you receive medical services – you’ll use the card that the insurance company gives you.

Many Advantage plans are HMOs, so you’d need to choose a primary doctor and get a referral to see a specialist. Others are PPOs, which do not require a primary care physician or referrals, but you’ll still need to stay in the provider network to receive the best benefits.

The good thing about Advantage plans is that most have a low or even $0 monthly premium (you just have to keep paying your Part B premium). The bad thing is that they have cost sharing in the form of copayments, a calendar year deductible, and coinsurance after the deductible. But they do have an out-of-pocket limit, so you have more protection than with Medicare alone.

The reason they’re called Advantage plans is because, in addition to providing everything Medicare does and capping your out-of-pocket spending, these plans also usually include some extra perks like dental or vision coverage. These are the programs you’ve probably seen old celebrities advertising on TV.

Advantage plans are “guaranteed issue,” meaning that they don’t ask medical questions, and you can’t be turned down because of pre-existing conditions.

To learn more about Advantage plans, you may want to take a look at this resource from Medicare.gov: Understanding Medicare Advantage Plans

Medicare Supplements

The other option is a Medicare supplement, also known as a Medigap plan. With a supplement, you still use your Medicare card and the government still pays its amount, but then the supplement fills in the holes, or at least most of the holes.

We normally recommend a Plan G supplement, which fills all of the gaps in original Medicare with the exception of the Part B deductible ($226 in 2023). So, for any covered service, that’s all that you would pay for the year. Obviously, that’s way better than the health plan that you currently have. And the monthly premium through ___ Insurance Company for a [male or female, smoker or non-smoker] in ____ County at age 65 is $____, which is also way better than your current plan. You do have other Medigap options, but this an example from one of the insurers we work with.

Medicare supplements are guaranteed issue for the first 6 months after you turn 65. After that, if you wanted to buy a supplement or switch to another one, you’d have to answer medical questions and could be turned down. For that reason, people tend to stick with their supplement for a long time, which means that the year 1 rate isn’t as important as the rate increases over time. As you get older, the rates will go up with every insurance company, but it’s a good idea to pick one with a history of more moderate increases. We can discuss the different supplement options when we talk.

Medicare Part D Drug Plan

If you do move forward with a supplement, you will also need to apply for a Part D prescription drug plan. These are built into many of the Advantage plans we offer, but a supplement does not include drug coverage.

The good news is that most drug plans are pretty affordable – the majority of our clients end up spending less than $30 per month for drug coverage. We can do a search on the Medicare.gov website based on your current prescriptions and your preferred pharmacies.

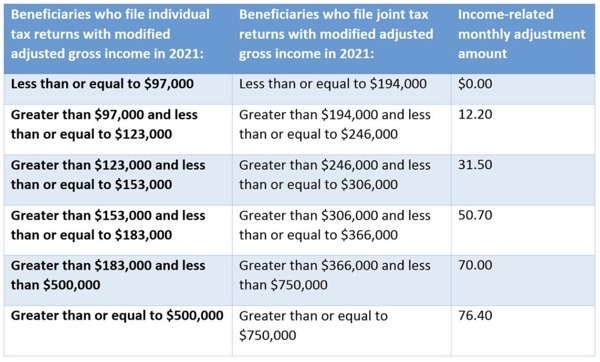

Just like with Part B, people over a certain income level do pay an additional surcharge on top of their monthly Part D drug premium. The below chart shows the extra charge at different income levels.

I know this is a lot of info, but, again, please let me know once you’ve had a chance to review it and we can schedule a time to discuss. Thank you!

Closing Thoughts

It takes a lot of work to put an email template like this together, so our thanks to Eric for sharing his.

While creating templates does take some time, having a resource like this that can be used again and again can save you a ton of time in the long run, so it’s definitely worth the effort. Instead of reinventing the wheel with each and every client, you can start off with a draft and then personalize it a little based on the client’s situation. Keep in mind that you’ll want to update your template with any relevant changes in Medicare. It’s a lot easier to edit than it is to start from scratch.

If you have any templates that you’re proud of and willing to share, please send them our way. We’ll be happy to post them and will be sure to give you credit.