Five Percent of People Have Huge Medical Bills

A recent article from Health Leaders Media summarizes the results of a global study from the Institute for Health Metrics and Evaluation (IHME) at the University of Washington. Here are a few of the findings:

- “The United States exceeds every other nation in total healthcare costs.”

- The average cost of an outpatient visit in the United States is nearly $500.

- The average inpatient stay in the United States costs more than $22,000.

- Higher utilization is observed among females during reproductive years.

- “[G]lobally, visits per person and admissions per person increase with age, beginning around age 25 for visits, and age 50 for admissions.”

So, overall, the United States spends more on healthcare than the rest of the world, younger females tend to be higher utilizers, people have more doctor and hospital visits as they age, and inpatient stays are really expensive. You probably could have guessed all of that, but now there’s a study to prove it.

What you might be surprised about, though, is the findings of another study: five percent of people in the United States spend $50,000 or more on health care every year. That’s a lot of money.

According to a 2018 review by the Cleveland Clinic, the “top 5% of the population, in terms of healthcare use account for 50% of costs, and the “top 1% account for 23% of all expenditures and cost 10 times more per year than the average patient.”

While these numbers are disturbing, they’re not new. Forbes reported similar statistics in a 2014 article entitled How Risky Is It To Be Uninsured? The article explains that “Health insurance—like auto, homeowners and other forms of property insurance—is designed to protect you from financial risk” and focuses on how big that risk is for people without health coverage.

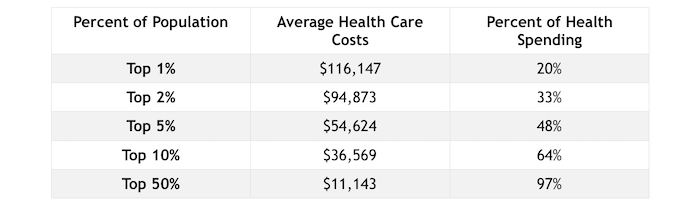

As the article points out, the top 1% of health care utilizers account for 20% of all health care spending in the United States with more than $115,000 in expenses each per year. The top 5% of utilizers account for 50% of health care spending with an average of $54,624 in expenses.

Source: Forbes.com (adapted from The American Health Economy Illustrated Online)

To summarize, a small percentage of the population is driving a big percentage of total health spending, and the top half of the population accounts for 97% of all health care expenses. The problem is that the only way to keep premiums under control is to convince the bottom half of the population—the portion that collectively accounts for only 3% of health care expenses—to buy health insurance “just in case.” However, with average annual premiums approaching $6,000 and average health care expenses of just $400 per year for the bottom 50% of health care utilizers, this isn’t an easy sell. And, as more and more healthy individuals find other options like short term plans or choose to go without health insurance altogether, the premiums for those with medical conditions continue to rise.

What this all means

Obviously, this sort of data is important to policymakers who continue to struggle with the challenge of ensuring that all citizens have access to quality, affordable health coverage, but why is this information important to brokers? It’s simple: because the conversations we have with our clients will be very different depending on their position in the above chart.

If a client is in the top 50% of health care utilizers, the group that spends more than $11,000 per year on average, it’s easy to convince them of the value of health insurance. It’s not difficult, for example, to explain to a five-percenter why it’s a good idea to spend $6,000 in premiums in order to save a big chunk of their $50,000+ in health care costs.

However, it is more difficult to explain to a family of four why they should collectively spend more than $20,000 per year on health insurance when the whole family has less than $1,000 per year in health care expenses. For these clients, you should focus not on what their current, predictable expenses are but rather what they could be. People buy insurance because anything can happen, and nobody can predict the future. For low utilizers, you should point out that even healthy people have accidents and that the average inpatient stay costs $22,000. While nobody likes paying for health insurance, people are always glad they have it when something happens.

If your prospects don’t buy it, meaning they don’t buy this argument so they don’t buy the policy, then you should at least try to sell them some supplemental coverage like accident and critical illness insurance. No, it’s not a replacement for health insurance, but it is much less expensive and does provide some protection against unexpected medical bills.