Dependent Rates Soar in 2018

As you probably noticed during this year’s open enrollment period, the rates for children under age 21 have increased significantly, forcing many clients to ask if there’s another option. This is true for both individual and small group plans, and its cause dates back to some regulations issued by the Department of Health and Human Services (HHS) in December of 2016.

Each year, HHS publishes its Notice of Benefit and Payment Parameters, and the 2018 version of this notice was released about thirteen months ago. In it, HHS changed the federal age curve for the first time since the Affordable Care Act became law. Specifically, the age curve changed for people age 20 and under who have coverage in the individual and small group markets.

Most people are familiar with the 3:1 age rating required by the Affordable Care Act. It says that the rate insurance companies charge for people age 64 or older can be three times the rate they charge for a 21-year-old. If the cost for a 21-year-old employee, individual, or dependent is $315, for instance, the rate for a $64-year-old employee or individual would be $945. Everyone else’s premium is also a factor of the 21-year-old’s rates. For instance, a 46-year-old individual’s rating factor is 1.50, so his or her rate in this example would be $315 x 1.5 = $472.50.

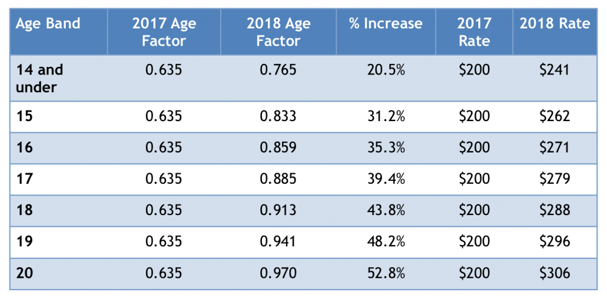

For anyone under age 21, the rating factor has been .635 since 2014, meaning that the rates for children and young adults up to age 20 have been 63.5% of the price of a 21-year-old. In our example, we would multiply the $315 rate by .635 for a rate of $200.03.

This recent change in the way child rates are calculated has had a huge impact on the price families pay for coverage in the individual market and on the rates charged for people with dependents on a small group policy. This also impacts the employee premium if a group is composite rated as employees absorb a portion of the rate increase on children.

The below table shows the new age rating factors and compares the $200 child rate in 2017 from our example with the new premiums for people under the age of 21. As you can see, the rates for all children and young adults increase, but the biggest impact occurs as people approach age 21.

Source for calculations: https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/Final-Guidance-Regarding-Age-Curves-and-State-Reporting-12-16-16.pdf

Source for calculations: https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/Final-Guidance-Regarding-Age-Curves-and-State-Reporting-12-16-16.pdf

At a time when premiums are already increasing by double digits, the new higher rates for children certainly isn’t welcome news, and some of your clients might be asking why the government changed its rating methodology. According to the Notice of Benefit and Payment Parameters, HHS believed that multiple child age bands will “better reflect the actuarial risk of children and to provide a more gradual transition from child to adult age rating.” In other words, after age 14 children tend to cost insurance companies more money, and the new rates better reflect the true risk.

The silver lining to the new rating methodology is that there could be an opportunity for agents who sell individual plans. As prices go up, employees with small group coverage may find it increasingly difficult to cover their children on their employer-sponsored health plan, especially if the company offers richer benefits, and they may find that there are less expensive options for their children in the individual market.

Of course, unless they qualify for a special enrollment period, these employees will likely need to wait until the 2019 open enrollment period to purchase individual coverage for their children. It’s never too early to start planning, though, so you may want to keep this in mind as you’re developing your marketing plan for 2018. Throughout the year, it would be a good idea to make some contacts with small employers and tell them how you might be able to help their employees who have children under age 21. After all, the best way to sell a lot of business at the end of the year is to start filling your pipeline at the beginning.